Essay

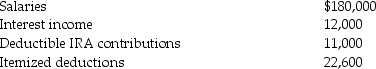

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2014. Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

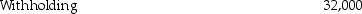

e.What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

Correct Answer:

Verified

Q15: If a 13-year-old has earned income of

Q21: If an individual with a marginal tax

Q55: The filing status in which the rates

Q71: Tony supports the following individuals during the

Q74: You may choose married filing jointly as

Q77: Generally,itemized deductions are personal expenses specifically allowed

Q93: Anita,who is divorced,maintains a home in which

Q111: For each of the following independent cases,indicate

Q113: Brett,a single taxpayer with no dependents,earns salary

Q1436: Mary Ann pays the costs for her