Multiple Choice

Perch Corporation has made paint and paint brushes for the past ten years.Perch Corporation is owned equally by Arnold,an individual,and Acorn Corporation.Perch Corporation has $100,000 of accumulated and current E&P.Both Arnold and Acorn Corporation have a basis in their stock of $10,000.Perch Corporation discontinues the paint brush operation and distributes assets worth $10,000 each to Arnold and Acorn Corporation in redemption of 20% of their stock.Due to the distribution,Arnold and Acorn Corporation must report:

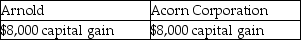

A)

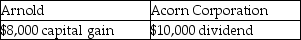

B)

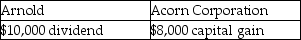

C)

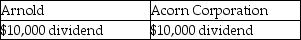

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In the current year,Ho Corporation sells land

Q7: John, the sole shareholder of Photo Specialty

Q15: What must be reported to the IRS

Q16: When is E&P measured for purposes of

Q47: Identify which of the following statements is

Q66: Elijah owns 20% of Park Corporation's single

Q82: Identify which of the following statements is

Q84: In a taxable distribution of stock, the

Q91: The gross estate of a decedent contains

Q106: Stone Corporation redeems 1,000 share of its