Essay

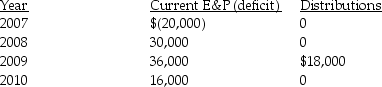

Omega Corporation is formed in 2006.Its current E&P and distributions for each year through 2010 are as follows:

Is the distribution made from current or accumulated E&P? At the beginning of 2011,what is accumulated E&P?

Is the distribution made from current or accumulated E&P? At the beginning of 2011,what is accumulated E&P?

Correct Answer:

Verified

The $18,000 distribution is made from 20...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: How does a shareholder classify a distribution

Q17: A shareholder's basis in property distributed as

Q27: Peter owns all 100 shares of Parker

Q36: Identify which of the following statements is

Q54: In a nontaxable distribution of stock rights,

Q75: Green Corporation is a calendar-year taxpayer.All of

Q80: Circle Corporation has 1,000 shares of common

Q86: When appreciated property is distributed in a

Q88: River Corporation's taxable income is $25,000, after

Q112: Which of the following is not a