Multiple Choice

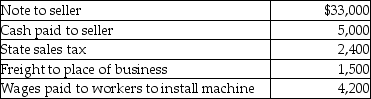

Dennis purchased a machine for use in his business.Mr.Dennis' costs in connection with this purchase were as follows:  What is the amount of Mr.Dennis' basis in the machine?

What is the amount of Mr.Dennis' basis in the machine?

A) $33,000

B) $40,400

C) $41,900

D) $46,100

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q29: Which one of the following is a

Q38: All of the following are capital assets

Q66: Adjusted net capital gain is taxed at

Q90: In a common law state,jointly owned property

Q106: In the current year,ABC Corporation had the

Q107: Sari is single and has taxable income

Q107: Bad debt losses from nonbusiness debts are

Q108: On January 1 of this year,Brad purchased

Q115: Gain on sale of a patent by