Multiple Choice

Gertie has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year.After gains and losses are offset,Gertie reports

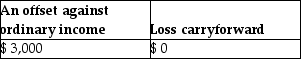

A)

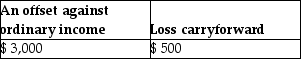

B)

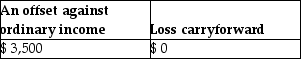

C)

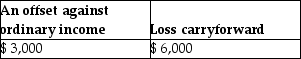

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Allison buys equipment and pays cash of

Q11: Stock purchased on December 15,2013,which becomes worthless

Q45: During the current year,Don's aunt Natalie gave

Q52: Candice owns a mutual fund that reinvests

Q66: Melanie,a single taxpayer,has AGI of $220,000 which

Q92: Dale gave property with a basis of

Q95: Armanti received a football championship ring in

Q100: If stock sold or exchanged is not

Q112: Section 1221 of the Code includes a

Q119: Melody inherited 1,000 shares of Corporation Zappa