Essay

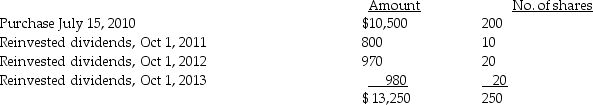

Joy purchased 200 shares of HiLo Mutual Fund on July 15,2009,for $10,500,and has been reinvesting dividends.On December 15,2014,she sells 100 shares.

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

Correct Answer:

Verified

Assuming FIFO,the basis in the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Taxpayers who own mutual funds recognize their

Q26: Arthur,age 99,holds some stock purchased many years

Q62: Section 1221 specifically states that inventory or

Q76: Because of the locked-in effect,high capital gains

Q95: Galvin Corporation has owned all of the

Q103: If the taxpayer's net long-term capital losses

Q104: The holding period of property received from

Q120: Antonio owns land held for investment with

Q122: With regard to taxable gifts after 1976,no

Q133: DeMarcus and Brianna are married and live