Essay

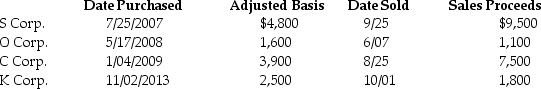

Mike sold the following shares of stock in 2014:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q29: Which one of the following is a

Q90: In a common law state,jointly owned property

Q91: Generally,gains resulting from the sale of collectibles

Q95: Galvin Corporation has owned all of the

Q115: Gain on sale of a patent by

Q119: Niral is single and provides you with

Q120: Kendrick,who has a 35% marginal tax rate,had

Q122: Sanjay is single and has taxable income

Q128: Normally,a security dealer reports ordinary income on