Essay

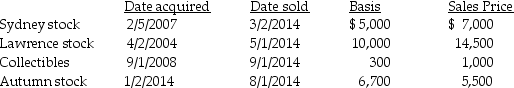

Chen had the following capital asset transactions during 2014:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Correct Answer:

Verified

Long-term  Short-ter...

Short-ter...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: All recognized gains and losses must eventually

Q41: Douglas and Julie are a married couple

Q55: Interest incurred during the development and manufacture

Q56: The gain or loss on an asset

Q60: Topaz Corporation had the following income and

Q75: Jack exchanged land with an adjusted basis

Q77: In a basket purchase,the total cost is

Q80: Jade is a single taxpayer in the

Q102: Gains and losses are recognized when property

Q129: Emma Grace acquires three machines for $80,000,which