Multiple Choice

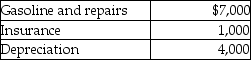

Rajiv,a self-employed consultant,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

A) $8,325

B) $9,000

C) $6,325

D) $7,000

Correct Answer:

Verified

Correct Answer:

Verified

Q13: An employer receives an immediate tax deduction

Q32: Jack takes a $7,000 distribution from his

Q63: Martin Corporation granted a nonqualified stock option

Q72: Mirasol Corporation granted an incentive stock option

Q72: All of the following are allowed a

Q73: Jackson Corporation granted an incentive stock option

Q94: In a contributory defined contribution pension plan,all

Q104: A gift from an employee to his

Q373: A taxpayer goes out of town to

Q1888: Deferred compensation refers to methods of compensating