Multiple Choice

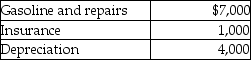

Jordan,an employee,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

A) $1,500

B) $500

C) $1,000

D) $8,000

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Tobey receives 1,000 shares of YouDog! stock

Q18: Which of the following is true about

Q27: Which of the following statements is incorrect

Q28: Raul and Jenna are married and are

Q31: In-home office expenses which are not deductible

Q34: Which of the following statements regarding Health

Q77: "Associated with" entertainment expenditures generally must occur

Q116: Ron is a university professor who accepts

Q150: Travel expenses related to foreign conventions are

Q590: When are home- office expenses deductible?