Multiple Choice

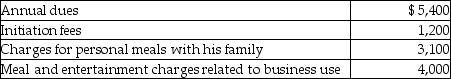

Joe is a self-employed tax attorney who frequently entertains his clients at his country club.Joe's club expenses include the following:  Assuming the business meals and entertainment qualify as deductible entertainment expenses,Joe may deduct

Assuming the business meals and entertainment qualify as deductible entertainment expenses,Joe may deduct

A) $2,000.

B) $4,700.

C) $5,300.

D) $4,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: All of the following are true with

Q9: All taxpayers are allowed to contribute funds

Q26: In a defined contribution pension plan,fixed amounts

Q63: A nondeductible floor of 2% of AGI

Q102: The following individuals maintained offices in their

Q108: Martin Corporation granted an incentive stock option

Q112: Feng,a single 40 year old lawyer,is covered

Q114: A tax adviser takes a client to

Q117: Norman traveled to San Francisco for four

Q1326: Gina is an instructor at State University