Multiple Choice

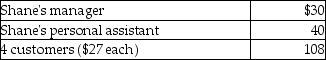

Shane,an employee,makes the following gifts,none of which are reimbursed:  What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

A) $125

B) $150

C) $75

D) $178

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: Tobey receives 1,000 shares of YouDog! stock

Q16: A contributor may make a deductible contribution

Q19: Which of the following conditions would generally

Q19: H (age 50)and W (age 48)are married

Q24: Ruby Corporation grants stock options to Iris

Q39: Wilson Corporation granted an incentive stock option

Q86: In addition to the general requirements for

Q103: Chuck, who is self- employed, is scheduled

Q109: According to the IRS,a person's tax home

Q1239: Fiona is about to graduate college with