Multiple Choice

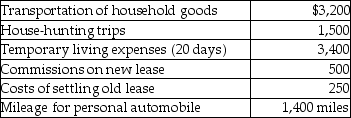

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

A) $3,529

B) $6,600

C) $9,179

D) $3,984

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Employees receiving nonqualified stock options recognize ordinary

Q37: Unreimbursed employee business expenses are deductions for

Q45: Under a qualified pension plan,the employer's deduction

Q50: In which of the following situations is

Q51: Frank is a self-employed CPA whose 2014

Q53: Which of the following statements regarding independent

Q55: In-home office expenses for an office used

Q86: Taxpayers may use the standard mileage rate

Q131: If the purpose of a trip is

Q133: An employer-employee relationship exists where the employer