Essay

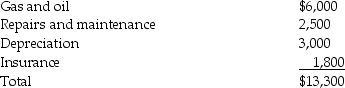

Sarah purchased a new car at the beginning of the year. She makes an adequate accounting to her employer and receives a $2,400 (12,000 miles × 20 cents per mile)reimbursement in 2014 for employment-related business miles.She incurs the following expenses related to both business and personal use:

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

What are the possible amounts of Sarah's deductible transportation expenses?

Correct Answer:

Verified

Actual expense method:  Standard mileage...

Standard mileage...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: In-home office expenses are deductible if the

Q32: Jack takes a $7,000 distribution from his

Q67: Charles is a self-employed CPA who maintains

Q72: All of the following are allowed a

Q73: Jackson Corporation granted an incentive stock option

Q81: During 2014,Marcia,who is single and is covered

Q92: Which of the following statements regarding Coverdell

Q118: All of the following may deduct education

Q146: Sarah incurred employee business expenses of $5,000

Q148: Generally,50% of the cost of business gifts