Essay

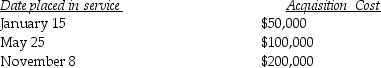

Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property in 2014 and does not use Sec.179. Mehmet places the property in service on the following schedule:

What is the total depreciation for 2012?

What is the total depreciation for 2012?

Correct Answer:

Verified

More than 40% of the assets a...

More than 40% of the assets a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: On May 1,2012,Empire Properties Corp.,a calendar year

Q26: Under MACRS,tangible personal property used in trade

Q31: The mid-quarter convention applies to personal and

Q32: Residential rental property is defined as property

Q33: If a new luxury automobile is used

Q34: Sec.179 tax benefits are recaptured if at

Q34: J.R.acquires an oil and gas property interest

Q45: Any Section 179 deduction that is not

Q70: Intangible drilling and development costs (IDCs)may be

Q82: In the current year George,a college professor,acquired