Essay

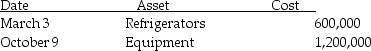

During the year 2014,a calendar year taxpayer,Marvelous Munchies,a chain of specialty food shops,purchased equipment as follows:

Assume the property is all 5-year property. What is the maximum depreciation that may be deducted for the assets this year,2014,assuming the alternative depreciation system is not chosen?

Assume the property is all 5-year property. What is the maximum depreciation that may be deducted for the assets this year,2014,assuming the alternative depreciation system is not chosen?

Correct Answer:

Verified

The mid-quarter convention mus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Under the MACRS system,depreciation rates for real

Q13: On its tax return,a corporation will use

Q22: For real property placed in service after

Q25: When a taxpayer leases an automobile for

Q38: In accounting for research and experimental expenditures,all

Q41: Costs that qualify as research and experimental

Q56: This year Bauer Corporation incurs the following

Q63: On June 30,2014,Temika purchased office furniture (7-year

Q65: A large SUV is place in service

Q80: Personal property used in a rental activity