Essay

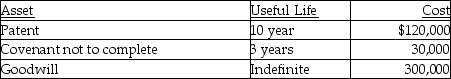

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million. Included in the assets acquired are the following intangible assets:

What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

Correct Answer:

Verified

The assets are Sec.197 acquisi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: All of the following are true with

Q14: If the business usage of listed property

Q26: In order for an asset to be

Q28: The Section 179 expensing election is available

Q34: J.R.acquires an oil and gas property interest

Q35: On October 2,2014,Dave acquired and placed into

Q43: Tessa owns an unincorporated manufacturing business.In 2014,she

Q49: In calculating depletion of natural resources each

Q87: The straight-line method may be elected for

Q96: Atiqa took out of service and sold