Multiple Choice

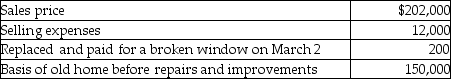

Frank,a single person age 52,sold his home this year. He had lived in the house for 10 years. He signed a contract on March 4 to sell his home and closed the sale on May 3. Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

A) $0

B) $39,800

C) $40,000

D) $52,000

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Trent,who is in the business of racing

Q23: If a principal residence is sold before

Q23: Patricia exchanges office equipment with an adjusted

Q34: James and Ellen Connors,who are both 50

Q35: Ed owns a racehorse with a $600,000

Q38: Cassie owns a Rembrandt painting she acquired

Q46: All of the following are true except:<br>A)A

Q56: For purposes of nontaxable exchanges,cash and non-like-kind

Q84: Under what circumstances can a taxpayer obtain

Q99: Vector Inc.'s office building burns down on