Multiple Choice

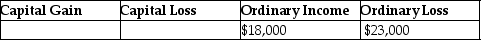

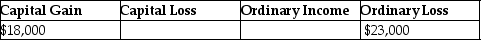

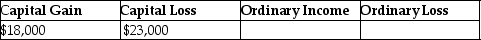

Jeremy has $18,000 of Section 1231 gains and $23,000 of Section 1231 losses.The gains and losses are characterized as

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Installment sales of depreciable property which result

Q9: Eric purchased a building in 2003 that

Q12: Cobra Inc.sold stock for a $25,000 loss

Q26: Terry has sold equipment used in her

Q26: A building used in a business for

Q43: In 1980,Artima Corporation purchased an office building

Q61: Douglas bought office furniture two years and

Q92: Gains and losses resulting from condemnations of

Q94: Costs of tangible personal business property which

Q100: For livestock to be considered Section 1231