Multiple Choice

Daniel recognizes $35,000 of Sec.1231 gains and $25,000 of Sec.1231 losses during the current year.The only other Sec.1231 item was a $4,000 loss three years ago.This year,Daniel must report

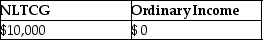

A)

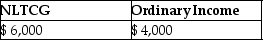

B)

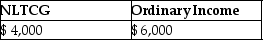

C)

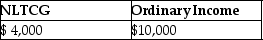

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q23: Blair,whose tax rate is 28%,sells one tract

Q25: If no gain is recognized in a

Q36: During the current year,Kayla recognizes a $40,000

Q37: During the current year,Hugo sells equipment for

Q40: During the current year,a corporation sells equipment

Q45: Gain recognized on the sale or exchange

Q61: WAM Corporation sold a warehouse during the

Q71: Clarise bought a building three years ago

Q79: Section 1231 property will generally have all

Q93: Sec.1245 applies to gains on the sale