Multiple Choice

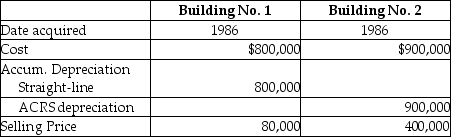

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for the first building and the accelerated method (ACRS) was used for the second building.Information about those buildings is presented below.  How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

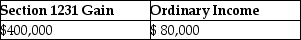

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

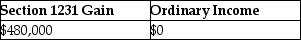

A)

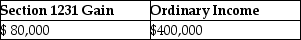

B)

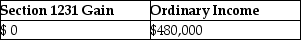

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Section 1245 recapture applies to all the

Q4: A corporation owns many acres of timber,which

Q24: On June 1,2011,Buffalo Corporation purchased and placed

Q29: A corporation sold a warehouse during the

Q52: If a taxpayer has gains on Sec.1231

Q55: In addition to the normal recapture rules

Q58: Unrecaptured 1250 gain is the amount of

Q59: Sec.1231 property must satisfy a holding period

Q77: The purpose of Sec.1245 is to eliminate

Q108: Depreciable property used in a trade or