Essay

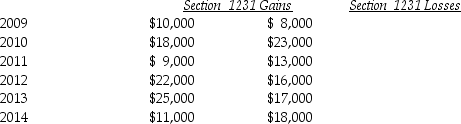

Lucy,a noncorporate taxpayer,experienced the following Section 1231 gains and losses during the years 2009 through 2014.Her first disposition of a Sec.1231 asset occurred in 2009. Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Section 1245 recapture applies to all the

Q17: All of the following statements are true

Q20: Melissa acquired oil and gas properties for

Q24: On June 1,2011,Buffalo Corporation purchased and placed

Q31: Jillian,whose tax rate is 39.6%,had the following

Q35: With regard to noncorporate taxpayers,all of the

Q55: In addition to the normal recapture rules

Q58: Unrecaptured 1250 gain is the amount of

Q77: The purpose of Sec.1245 is to eliminate

Q85: The sale of inventory results in ordinary