Essay

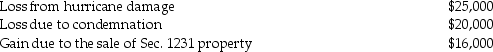

The following gains and losses pertain to Arnold's business assets that qualify as Sec.1231 property.Arnold does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Correct Answer:

Verified

The $25,000 casualty loss is an ordinary...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: A corporation owns many acres of timber,which

Q25: Ross purchased a building in 1985,which he

Q27: When appreciated property is transferred at death,the

Q38: Marta purchased residential rental property for $600,000

Q39: An unincorporated business sold two warehouses during

Q46: A taxpayer purchased a factory building in

Q52: If a taxpayer has gains on Sec.1231

Q59: Sec.1231 property must satisfy a holding period

Q87: When corporate and noncorporate taxpayers sell real

Q108: Depreciable property used in a trade or