Essay

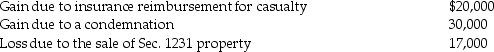

The following are gains and losses recognized in 2014 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Correct Answer:

Verified

The $20,000 gain from the casualty is tr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Frisco Inc.,a C corporation,placed a building in

Q20: The additional recapture under Sec.291 is 25%

Q22: Emily,whose tax rate is 28%,owns an office

Q28: With respect to residential rental property<br>A)80% or

Q32: Any gain or loss resulting from the

Q66: Section 1250 does not apply to assets

Q82: Sec.1245 ordinary income recapture can apply to

Q91: Brian purchased some equipment in 2014 which

Q92: Jesse installed solar panels in front of

Q109: Hilton,a single taxpayer in the 28% marginal