Essay

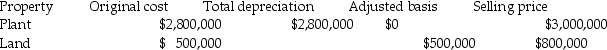

Julie sells her manufacturing plant and land originally purchased in 1980.Accelerated depreciation had been taken on the building,but the building is now fully depreciated.Julie is in the 39.6% marginal tax bracket.Other information is as follows:

She has not sold any other assets this year. A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year. What are the tax consequences of the sale (type of gain; rates at which taxed)?

She has not sold any other assets this year. A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year. What are the tax consequences of the sale (type of gain; rates at which taxed)?

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Pam owns a building used in her

Q15: Maura makes a gift of a van

Q22: Emily,whose tax rate is 28%,owns an office

Q30: Elaine owns equipment ($23,000 basis and $15,000

Q32: Any gain or loss resulting from the

Q91: Brian purchased some equipment in 2014 which

Q91: During the current year,George recognizes a $30,000

Q92: Jesse installed solar panels in front of

Q97: Why did Congress establish favorable treatment for

Q1297: Sarah owned land with a FMV of