Essay

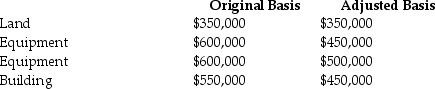

Describe the tax treatment for a noncorporate taxpayer in the 39.6% marginal tax bracket who sells each of the first two assets for $500,000 and each of the second two assets for $750,000.Each asset was purchased in 2010 and is used in a trade or business.There are no other gains and losses and no nonrecaptured Section 1231 losses.

Correct Answer:

Verified

• Land: $150,000 Section 1231 gain taxed...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: When gain is recognized on an involuntary

Q25: Ross purchased a building in 1985,which he

Q27: When appreciated property is transferred at death,the

Q39: An unincorporated business sold two warehouses during

Q44: Section 1250 could convert a portion of

Q48: Gifts of appreciated depreciable property may trigger

Q72: Sec.1245 can increase the amount of gain

Q84: When a donee disposes of appreciated gift

Q91: Indicate whether each of the following assets

Q102: Pete sells equipment for $15,000 to Marcel,his