Essay

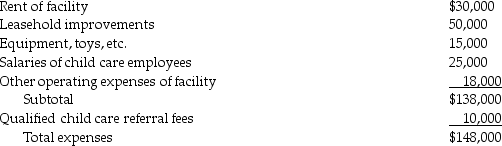

Hawaii,Inc.,began a child care facility for its employees during the year.The corporation incurred the following expenses:

What is the amount of Hawaii's credit for employer-provided child care?

What is the amount of Hawaii's credit for employer-provided child care?

Correct Answer:

Verified

The credit is ($138,000 × .25)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Self-employed individuals are subject to the self-employment

Q17: The child and dependent care credit provides

Q19: Mark and Stacy are married,file a joint

Q22: Tyne is single and has AGI of

Q25: In the fall of 2014,James went back

Q26: Lavonne has a regular tax liability of

Q34: The maximum amount of the American Opportunity

Q122: Refundable tax credits<br>A)only offset a taxpayer's tax

Q123: Bob's income can vary widely from year-to-year

Q130: In computing AMTI,adjustments are<br>A)limited.<br>B)added only.<br>C)subtracted only.<br>D)either added