Essay

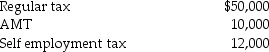

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Correct Answer:

Verified

a.The taxpayers should pay in...

a.The taxpayers should pay in...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: In computing AMTI,tax preference items are<br>A)excluded.<br>B)added only.<br>C)subtracted

Q64: Ivan has generated the following taxes and

Q65: In 2014 Rita is divorced with one

Q74: If a taxpayer's AGI is greater than

Q84: One-half of the self-employment tax imposed is

Q88: Max and Alexandra are married and incur

Q112: Nonrefundable tax credits<br>A)only offset a taxpayer's tax

Q117: Kors Corporation has 30 employees and $5

Q126: Which of the following statements is incorrect

Q200: Describe the differences between the American Opportunity