Multiple Choice

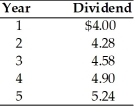

A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year.A new issue of stock is expected to be sold for $98,with $2 per share representing the underpricing necessary in the competitive capital market.Flotation costs are expected to total $1 per share.The dividends paid on the outstanding stock over the past five years are as follows:  The cost of this new issue of common stock is ________.

The cost of this new issue of common stock is ________.

A) 5.8 percent

B) 7.7 percent

C) 10.8 percent

D) 12.8 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Since retained earnings are viewed as a

Q10: The after-tax cost of debt for a

Q11: The four basic sources of long-term funds

Q12: Which of the following is TRUE of

Q13: Table 9.3<br>Balance Sheet<br>General Talc Mines<br>December 31,2019 <img

Q14: The _ is the firm's desired optimal

Q14: If a corporation pays a tax rate

Q15: A firm finances its activities with both

Q47: Although a firm's existing mix of financing

Q71: Table 9.1<br>A firm has determined its optimal