Multiple Choice

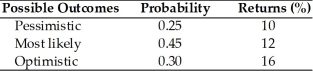

The expected value and the standard deviation of returns for asset A is ________.(See below.) Asset A

A) 12 percent and 4 percent

B) 12.7 percent and 2.3 percent

C) 12.7 percent and 4 percent

D) 12 percent and 2.3 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q28: The _ describes the relationship between nondiversifiable

Q30: Suppose the CAPM is true.Asset X has

Q31: For a risk-averse investor,required return would decrease

Q37: The difference between the return on the

Q59: If you expect the market to increase

Q61: Changes in risk aversion, and therefore shifts

Q80: Akai has a portfolio of three assets.

Q100: Last year, Mike bought 100 shares of

Q132: Nondiversifiable risk reflects the contribution of an

Q149: What is Nico's portfolio beta if he