Essay

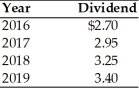

Tangshan Antiques has a beta of 1.40,the annual risk-free rate of interest is currently 10 percent,and the required return on the market portfolio is 16 percent.The firm estimates that its future dividends will continue to increase at an annual compound rate consistent with that experienced over the 2016-2019 period.  (a)Estimate the value of Tangshan Antiques stock.

(a)Estimate the value of Tangshan Antiques stock.

(b)A lawsuit has been filed against the company by a competitor in 2019,and the potential loss has increased risk,which is reflected in the company's beta,increasing it to 1.6.What is the estimated price of the stock following the filing of the lawsuit in 2019?

Correct Answer:

Verified

(a)rs = 0.10 + 1.4(0.16 - 0.10)= 0.184 gr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Nico bought 100 shares of a company's

Q47: The steeper the slope of the security

Q48: A portfolio of two negatively correlated assets

Q61: The _ the coefficient of variation, the

Q91: Table 8.2<br>You are going to invest $20,000

Q110: Unsystematic risk can be eliminated through diversification.

Q133: In the capital asset pricing model, the

Q169: The risk of a portfolio containing international

Q171: Unsystematic risk _.<br>A) does not change<br>B) can

Q181: Interest rate risk is the chance that