Essay

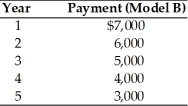

You are considering the purchase of new equipment for your company and you have narrowed down the possibilities to two models which perform equally well.However,the method of paying for the two models is different.Model A requires $5,000 per year payment for the next five years.Model B requires the following payment schedule.Which model should you buy if your opportunity cost is 8 percent?

Correct Answer:

Verified

Model A: PV = (CF/i)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: The New York Soccer Association would like

Q28: Everything else being equal, the higher the

Q80: Mr. Jackson has been awarded a bonus

Q83: The rate of interest actually paid or

Q134: The present value of an ordinary annuity

Q135: An annuity due is a stream of

Q139: Since individuals generally have opportunities to earn

Q140: The future value of $200 received today

Q142: The future value of a $10,000 annuity

Q146: In general, with an amortized loan, the