Multiple Choice

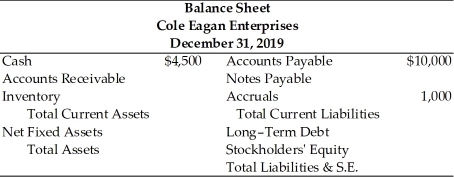

Table 3.1  Information (2019 values)

Information (2019 values)

1.Sales totaled $110,000

2.The gross profit margin was 25 percent.

3.Inventory turnover was 3.0.

4.There are 360 days in the year.

5.The average collection period was 65 days.

6.The current ratio was 2.40.

7.The total asset turnover was 1.13.

8.The debt ratio was 53.8 percent.

-Inventory for CEE in 2019 was ________.(See Table 3.1)

A) $36,667

B) $32,448

C) $27,500

D) $9,167

Correct Answer:

Verified

Correct Answer:

Verified

Q24: _ ratios are a measure of the

Q68: The average payment period can be calculated

Q78: A U.S. parent company's foreign retained earnings

Q122: The letter to stockholders is the primary

Q123: Table 3.1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5563/.jpg" alt="Table 3.1

Q126: The financial leverage multiplier is the ratio

Q127: Construct the DuPont system of analysis using

Q128: In 2018,Target Corp.reported sales of $71.9 billion,cost

Q129: Table 3.2<br>Dana Dairy Products Key Ratios <img

Q130: A firm with a gross profit margin