Multiple Choice

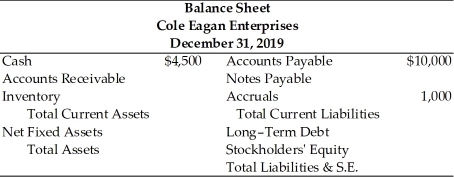

Table 3.1  Information (2019 values)

Information (2019 values)

1.Sales totaled $110,000

2.The gross profit margin was 25 percent.

3.Inventory turnover was 3.0.

4.There are 360 days in the year.

5.The average collection period was 65 days.

6.The current ratio was 2.40.

7.The total asset turnover was 1.13.

8.The debt ratio was 53.8 percent.

-Long-term debt for CEE in 2019 was ________.(See Table 3.1)

A) $30,763

B) $52,372

C) $10,608

D) $41,372

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following represents a current

Q32: The use of differing accounting treatments-especially relative

Q50: The basic inputs to an effective financial

Q64: The Financial Accounting Standards Board (FASB) Standard

Q110: Return on total assets (ROA) measures the

Q128: Earnings per share represents the dollar amount

Q137: In 2018,Target Corp.reported sales of $71.9 billion,cost

Q138: Which of the following is TRUE?<br>A)For most

Q139: The gross profit margin measures the percentage

Q140: Below are recent inventory turnover ratios for