Essay

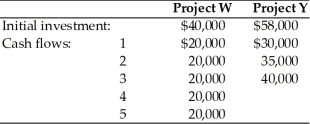

A firm is evaluating two mutually exclusive projects that have unequal lives.The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select.The firm's cost of capital has been determined to be 18 percent,and the projects have the following initial investments and cash flows:

Correct Answer:

Verified

ANPV of Project W: $22,540/3....

ANPV of Project W: $22,540/3....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A mixer was purchased two years ago

Q9: Breakeven cash inflow refers to _.<br>A)the minimum

Q10: Table 11.9<br>Johnson Farm Implement is faced with

Q12: If an asset is sold for more

Q15: Suppose the tax law changes to allow

Q42: A firm with limited funds for investment

Q60: Even though a business firm can be

Q67: When unequal-lived projects are independent, the impact

Q76: In capital budgeting, one of the most

Q106: An opportunity cost is a cash flow