Multiple Choice

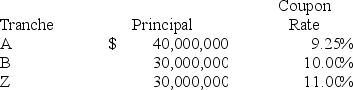

A mortgage company is issuing a CMO with three tranches,with the principal and coupon rate given in the table below.When issued,the weighted average coupon on the CMO will be:

A) 9.25%

B) 10.00%

C) 10.08%

D) 11.00%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q19: The total interest collected from the pool

Q20: These items are hybrid securities that contain

Q21: Class A investors are sometimes repaid with

Q22: Investors retain prepayment risk on MBBs,but issuers

Q23: CMO investors only pay taxes on interest

Q25: What is the primary distinction between mortgage-related

Q26: The credit rating of an MPTB depends

Q27: Cash flows remaining after all CMO tranches

Q28: In comparison to other mortgage-backed securities,the unique

Q29: From the issuer's perspective,the use of MBBs