Multiple Choice

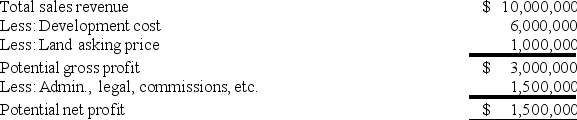

Consider the feasibility study shown in the table.You have been advised that sales revenues may be 10 percent lower and/or development costs may be 10 percent higher.Performing a sensitivity analysis,you conclude:

A) A 10 percent decrease in sales revenues would have a bigger impact on returns than a 10 percent increase in development costs

B) A 10 percent increase in development costs would have a bigger impact on returns than a 10 percent decrease in sales revenues

C) A 10 percent increase in development costs and a 10 percent decrease in sales revenues would have opposite impacts on returns,canceling each other out and having no impact on returns

D) Both factors would have such a small impact,that there is no reason to be concerned about either a 10 percent increase in development costs or a 10 percent decrease in sales revenues

Correct Answer:

Verified

Correct Answer:

Verified

Q8: A lender does not usually require a

Q9: The release price is the dollar amount

Q10: Generally,which of the following is FALSE regarding

Q11: The release schedule refers to a schedule

Q12: Consider the table,which summarizes monthly construction draws

Q14: Which of the following does NOT contribute

Q15: It is proper to include an estimate

Q16: By using an option contract,a developer may

Q17: Which of the following costs should NOT

Q18: A developer must sell all of the