Multiple Choice

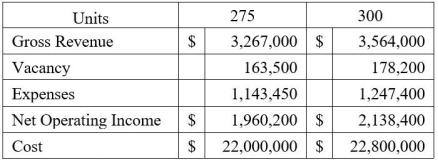

Consider the table above.An investor-developer demands a return of at least 9 percent on cost.Which of the following statements is TRUE based on the information above?

Consider the table above.An investor-developer demands a return of at least 9 percent on cost.Which of the following statements is TRUE based on the information above?

A) Neither project produces a sufficient expected return

B) The 275 unit project produces a sufficient return,but the 300 unit project does not

C) The 300 unit project produces a sufficient return,but the 275 unit project does not

D) Both projects produce sufficient return,but the 275 unit project produces a higher return than the 300 unit project

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Which of the following is NOT one

Q5: Holdbacks are used by construction lenders to

Q6: In general,developers must get a construction loan

Q7: Generally,as the cost of a site increases,so

Q8: In the context of a lease,percentage rents

Q10: Mini-perm loans usually refer to financing:<br>A)At local

Q11: Which of the following is FALSE regarding

Q12: What term applies to third-party financing that

Q13: Commitments for construction financing are usually contingent

Q14: Loans made under the assumption that markets