Multiple Choice

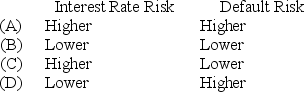

Which of the following descriptions most accurately reflects the risk position of an ARM lender in comparison to that of a FRM lender?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The expected cost of borrowing depends on

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5566/.jpg" alt=" With which loan

Q22: What is the meaning of the following:

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5566/.jpg" alt=" Which loan in

Q24: ARMs help lenders combat unanticipated inflation changes,interest

Q25: Characteristics of a PLAM include an increasing

Q26: Negative amortization reduces the principal balance of

Q27: The default risk of a FRM is

Q28: Which of the following clauses leads to

Q30: A borrower takes out a 30-year adjustable