Multiple Choice

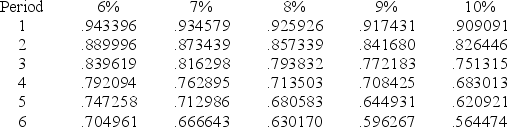

Using only the information in the table below,what would the IRR be for an investment that cost $500 in period 0 and was sold for $750 in period 5? Present Value Factor for Reversion of $1

A) Between 6% and 7%

B) Between 7% and 8%

C) Between 8% and 9%

D) Between 9% and 10%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: The future value compound factor given for

Q7: For situations calling for other than annual

Q8: You always see an ordinary annuity used

Q9: In order to solve a compounding problem,you

Q10: If you saw a table containing the

Q12: One way to calculate the present value

Q13: If an investment earns 12% annually:<br>A)An equivalent

Q14: At the end of 8 years,your friend

Q15: Begin with a single sum of money

Q16: Your friend has a trust fund that