Multiple Choice

Use the information for the question(s) below.

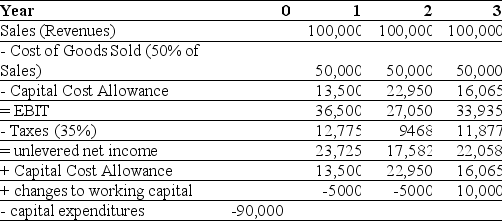

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projects:

-The free cash flow for the first year of Epiphany's project is closest to:

A) $43,000

B) $25,000

C) $32,225

D) $45,000

E) $35,532

Correct Answer:

Verified

Correct Answer:

Verified

Q17: What is the major difference between scenario

Q35: What are the most difficult parts of

Q72: Assume that THSI's cost of capital for

Q73: A bakery invests $30,000 in a light

Q75: The change in net working capital from

Q78: Athabasca Ag is purchasing 1,000 grain bins

Q79: A construction company spends $1.4 million to

Q80: The difference between scenario analysis and sensitivity

Q81: A bakery invests $30,000 in a light

Q82: Use the table for the question(s)below.<br> <img