Multiple Choice

Use the information for the question(s) below.

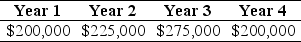

The Sisyphean Company is planning on investing in a new project.This will involve the purchase of some new machinery costing $450,000.The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.

-The net present value (NPV) for this project is closest to:

A) $176,270

B) $123,420

C) $450,000

D) $179,590

E) $497,062

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Net present value (NPV) is usefully supplemented

Q6: Use the table for the question(s)below.<br>Consider the

Q10: Use the table for the question(s)below.<br>Consider a

Q11: When comparing two projects with different lives,why

Q13: Use the table for the question(s)below.<br>Consider the

Q20: When different projects put different demands on

Q76: Should personal preferences for cash today versus

Q89: Net present value (NPV) is the difference

Q104: What is the Net Present Value rule?

Q110: When comparing mutually exclusive projects which have