Multiple Choice

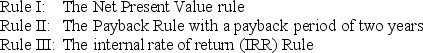

Mary is in contract negotiations with a publishing house for her new novel.She has two options.She may be paid $100,000 up front,and receive royalties that are expected to total $26,000 at the end of each of the next five years.Alternatively,she can receive $200,000 up front and no royalties.Which of the following investment rules would indicate that she should take the former deal,given a discount rate of 8%?

A) Rule I only

B) Rule III only

C) Rules II and III

D) Rules I and II

E) Rules I and III

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Preference for cash today versus cash in

Q36: Use the information for the question(s)below. <img

Q37: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" A print shop

Q39: Which of the following formulas regarding net

Q40: Why is the internal rate of return

Q42: A lottery winner can take $6 million

Q43: A local government awards a landscaping company

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" A small department

Q46: Most corporations measure the value of a

Q103: What is a safe method to use