Multiple Choice

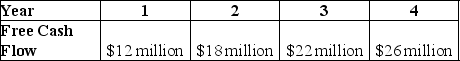

Use the table for the question(s) below.

-Conundrum Mining is expected to generate the above free cash flows over the next four years,after which they are expected to grow at a rate of 5% per year.If the weighted average cost of capital is 12% and Conundrum has cash of $80 million,debt of $60 million,and 30 million shares outstanding,what is Conundrum's expected terminal enterprise value?

A) $371.4 million

B) $390.0 million

C) $410.0 million

D) $391.4 million

E) $403.6 million

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Coolibah Holdings is expected to pay dividends

Q3: If you want to value a firm

Q5: Bondi Company is expected to pay a

Q6: Avril Synchronistics will pay a dividend of

Q7: Xport International just announced that it plans

Q8: Forecasting dividends requires forecasting the firm's future

Q10: Valence Electronics has 217 million shares outstanding.It

Q11: Assuming everything else remains unchanged, how does

Q11: Von Bora Corporation (VBC)is expected to pay

Q13: Can the dividend-discount model handle negative growth