Multiple Choice

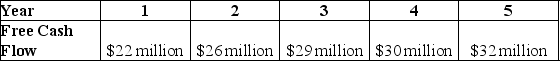

Use the table for the question(s) below.

-General Industries is expected to generate the above free cash flows over the next five years,after which free cash flows are expected to grow at a rate of 3% per year.If the weighted average cost of capital is 8% and General Industries has cash of $10 million,debt of $40 million,and 80 million shares outstanding,what is General Industries' expected terminal enterprise value?

A) $558.2 million

B) $109.5 million

C) $442.8 million

D) $513.6 million

E) $659.2 million

Correct Answer:

Verified

Correct Answer:

Verified

Q3: In the method of comparables, the known

Q9: What are the implications of the efficient

Q11: In an efficient market, investors will only

Q64: With more firms introducing stock repurchase plans,how

Q65: If you want to value a firm

Q66: Flinders Corporation's shares currently cost $32.00,and it

Q69: If you want to value a firm

Q70: A stock is expected to pay $0.80

Q71: Advanced Chemical Industries is awaiting the verdict

Q73: Use the figure for the question(s)below. <img