Multiple Choice

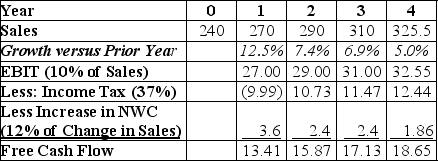

Use the table for the question(s) below.

-Banco Industries expects sales to grow at a rapid rate over the next 3 years,but settle to an industry growth rate of 5% in year 4.The spreadsheet above shows a simplified pro forma for Banco Industries.Banco Industries has a weighted average cost of capital of 12%,$50 million in cash,$60 million in debt,and 18 million shares outstanding.If Banco Industries can reduce their operating expenses so that EBIT becomes 12% of sales,by how much will their stock price increase?

A) $2.80

B) $3.36

C) $4.98

D) $8.89

E) $10.12

Correct Answer:

Verified

Correct Answer:

Verified

Q94: Use the table for the question(s)below.<br> <img

Q95: Kilbright Corporation stock is currently trading at

Q96: Wellington Corporation is expected to pay a

Q97: Aaron Inc.has 316 million shares outstanding.It expects

Q98: You expect KT industries (KTI)will have earnings

Q100: Which of the following tendencies of individual

Q101: Praetorian Industries will pay a dividend of

Q102: Harbour Corporation pays a dividend of $2.15

Q103: Kirkevue Industries pays out all its earnings

Q104: Jumbuck Exploration has a current stock price