Multiple Choice

Which of the following best shows the timeline for cash flows from a five-year bond with a face value of $2,000,a coupon rate of 4.2%,and semi-annual payments?

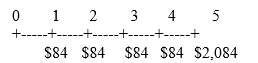

A)

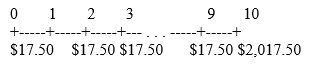

B)

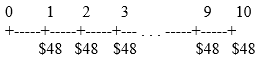

C)

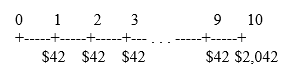

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q29: How are the cash flows of a

Q71: Under what situation can a zero-coupon bond

Q71: Which of the following statements is TRUE?<br>A)A

Q72: What is the coupon rate of a

Q76: Use the information for the question(s)below.<br> <img

Q77: How are investors in zero-coupon bonds compensated

Q78: Which of the following best describes a

Q79: Use the table for the question(s)below.<br>The following

Q80: What is the yield to maturity of

Q97: A bond is said to mature on