Multiple Choice

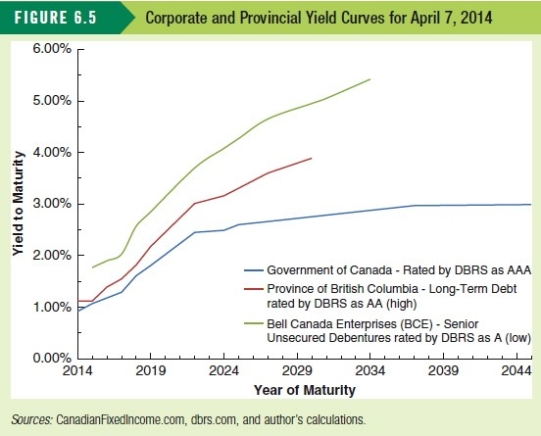

Based on Figure 6.5,which of the following is least likely to default?

Based on Figure 6.5,which of the following is least likely to default?

A) Bell Canada Enterprises

B) Province of British Columbia

C) Government of Canada

D) All of the above

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: A risk-free,zero-coupon bond has 15 years to

Q2: How much will the coupon payments be

Q4: Consider a zero-coupon bond with a $1000

Q5: How much will the coupon payments be

Q6: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" Consolidated Insurance wants

Q7: A $10,000 bond with a coupon rate

Q8: What is the coupon rate of a

Q9: Which of the following bonds will be

Q10: Assuming the appropriate YTM on the Sisyphean

Q11: How much will the coupon payments be