Multiple Choice

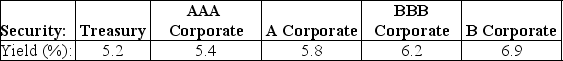

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

- The credit spread of the B corporate bond is closest to:

The credit spread of the B corporate bond is closest to:

A) 1.6%

B) 0.8%

C) 1.0%

D) 1.4%

E) 1.8%

Correct Answer:

Verified

Correct Answer:

Verified

Q26: A bond has three years to maturity,a

Q27: A bond is currently trading below par.Which

Q28: A bond with semi-annual coupon payments of

Q29: An investor purchases a 30-year,zero-coupon bond with

Q30: A ten-year,zero-coupon bond with a yield to

Q32: Why do bond prices increase as the

Q33: A firm issues 20-year bonds with a

Q34: Use the table for the question(s)below.<br>The following

Q35: Assuming the appropriate YTM on the Sisyphean

Q36: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" What is the