Multiple Choice

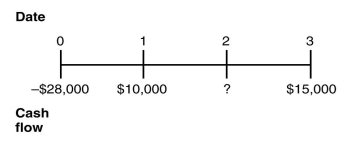

You are offered an investment opportunity that costs you $28,000,has a net present value (NPV) of $2278,lasts for three years,has interest rate of 10%,and produces the following cash flows:  The missing cash flow from year 2 is closest to:

The missing cash flow from year 2 is closest to:

A) $12,500

B) $12,000

C) $13,000

D) $10,000

E) $14,000

Correct Answer:

Verified

Correct Answer:

Verified

Q60: Define the following terms:<br>(a)perpetuity<br>(b)annuity<br>(c)growing perpetuity<br>(d)growing annuity

Q91: An investor receives $250,000 at the end

Q92: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" What is the

Q93: Which of the following investments has a

Q94: Assuming that college costs continue to increase

Q95: What is the PV of an investment

Q96: Allan decides to invest in a new

Q97: A bank is negotiating a loan.The loan

Q98: An investment of $6000 at the start

Q99: You are given two choices of investments,Investment